The Evolution of Credit Cards: From Plastic to Digital

3 min read

20 Aug 2025

The journey of credit cards has been nothing short of remarkable. From their humble beginnings as plastic rectangles, they've transformed into digital powerhouses that drive the modern economy. This article takes a closer look at the evolution of credit cards, tracing their history from inception to their current digital avatars, and explores how they continue to shape the way we manage our finances.

Birth of the Plastic Card

Credit cards made their debut in the mid-20th century as plastic cards that allowed consumers to make purchases on credit. The idea was simple: instead of carrying cash, you could carry a card with a spending limit. The concept quickly gained popularity among consumers and businesses alike, simplifying transactions and reducing the need for cash.

Magnetic Stripes and Embossed Numbers

In the 1970s, credit cards received a significant upgrade with the introduction of magnetic stripes and embossed numbers. The magnetic stripe technology allowed for faster and more secure transactions, while embossed numbers added an extra layer of security by making it harder to counterfeit cards. These innovations made credit cards even more convenient and widely accepted.

The Digital Revolution

The late 20th century saw the advent of the internet and e-commerce. This digital revolution paved the way for credit cards to go digital. The introduction of online banking and electronic payment systems allowed consumers to make purchases and manage their accounts online. It was a game-changer that set the stage for the next phase of credit card evolution.

From Plastic to Digital Wallets

With the rise of smartphones, credit cards took on a new form: digital wallets. Digital payment platforms like Apple Pay, Google Pay, and Samsung Pay allowed users to store their card information securely on their devices and make contactless payments with a simple tap. These digital wallets not only increased convenience but also enhanced security through encryption and tokenization.

Contactless and Cryptocurrencies

In recent years, credit cards have embraced contactless technology, enabling users to make payments by tapping their cards or smartphones at point-of-sale terminals. Moreover, the emergence of cryptocurrencies has introduced new possibilities. Some credit card companies now offer crypto rewards, allowing users to earn and spend digital currencies alongside traditional fiat currencies.

Conclusion: The Digital Frontier

The evolution of credit cards from plastic to digital represents a journey of innovation and adaptation. They have not only simplified our financial lives but have also kept pace with the digital age. As we move forward, credit cards will likely continue to evolve, integrating new technologies and offering even greater flexibility and security. They remain a fundamental tool in the world of finance, bridging the gap between the physical and digital realms of commerce.

More Articles

Controversy Erupts: Criticism Over Bhagavad Gita Quote's Use in Oppenheimer Sex Scene as 'Absolutely Unnecessary

2 min read | 11 Jul 2025

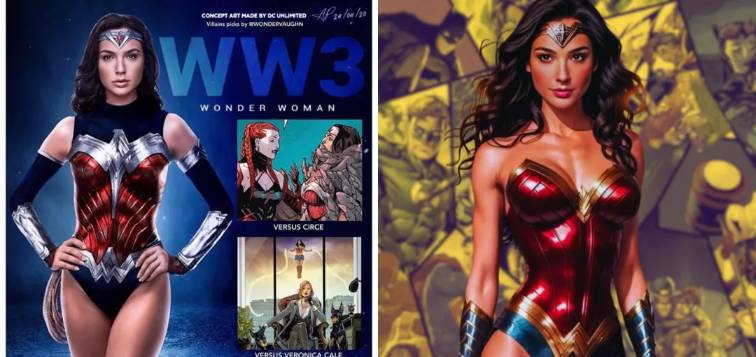

Uncertain Future: DC's Current Stance on 'Wonder Woman 3' Reveals No Immediate Plans for the Film

2 min read | 10 Jul 2025

Will Smith's Candid Revelation to Jada Pinkett About His Divorce from Sheree Fletcher in 1995

2 min read | 09 Jul 2025